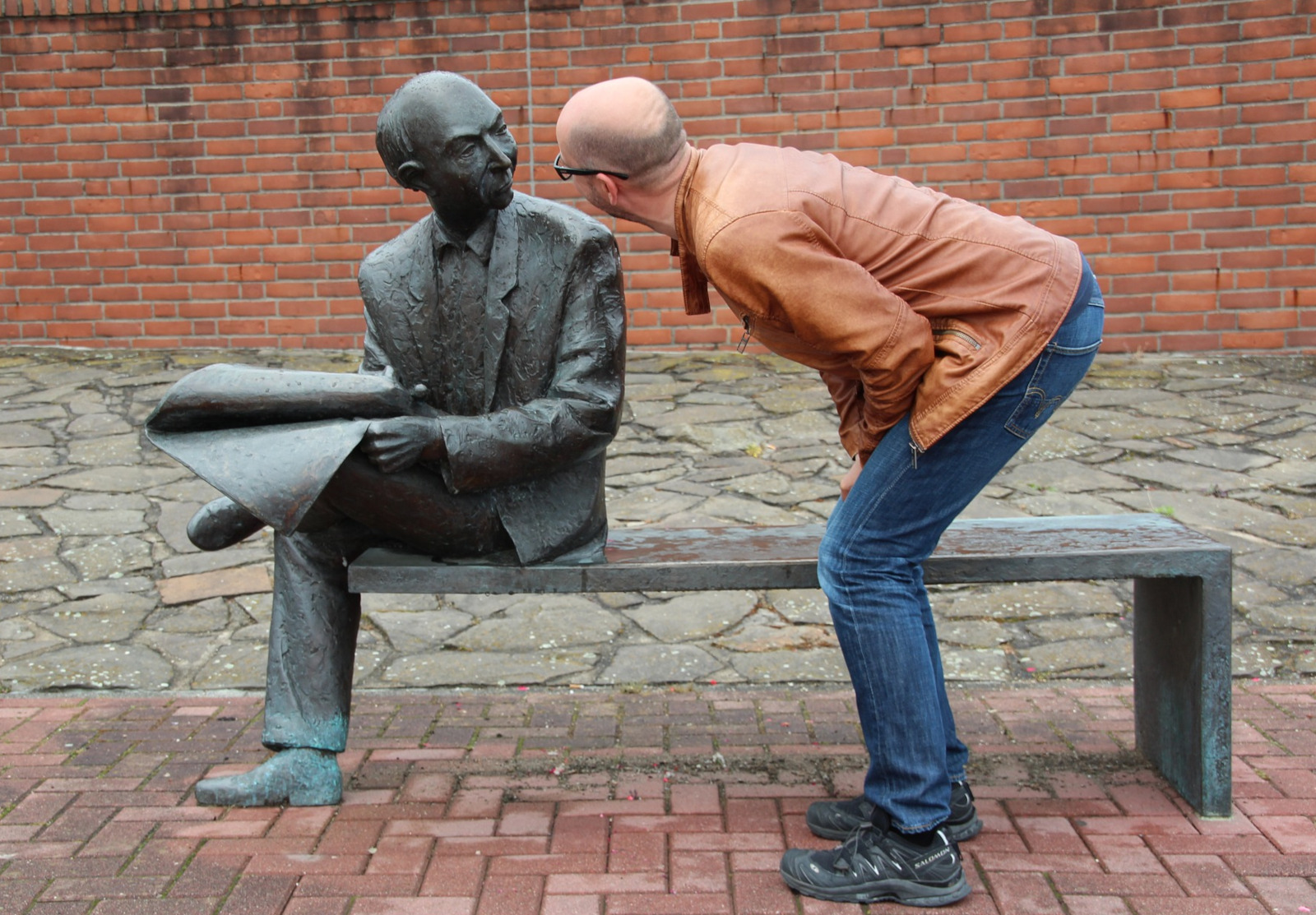

Image by Peggy und Marco Lachmann-Anke from Pixabay

Some of life’s mistakes are easy to fix. These aren’t, and you might not even realize you’re making them.

Most of us think of retirement as the culmination of a long, hard career. It’s the final stage of our life where we get to relax and enjoy ourselves for a change. We deserve it, we’re owed it.

But where is it written that retirement is your birthright? Who owes it to you? Your company? No, they’ll replace you in a New York minute and move on without looking back. The government? Social Security? They’ll give you exactly what you earned and not a penny more, even if you need it. And what they give you won’t be enough to retire on, not even close. So who’s responsible?

You! That’s who. You are solely responsible for making good choices that provide you with a comfortable retirement. Not a Bezos retirement with yachts and spaceships, just a regular comfortable retirement with a lifestyle similar to when you worked. That’s all.

Put away some money and it’ll work out fine. Okay, that’s one of many things you should do, but there’s more. You can find long lists of “retirement tips” and “essential retirement steps” in every bookstore and retirement blog.

But what about all those things you shouldn’t do? Well, here they are (and for God’s sake, don’t do them!):

1. Self-deception

How many times have you heard (or thought) “I love my work. I’m a workaholic. I don’t want to quit. I’ll never retire!” Now, how many people do you know who literally worked until the day they died? “None” seems like a good guess. No matter what you tell yourself, the fact is everyone WILL retire one day. Whether you like it or not, something will happen — life, spouse, illness, job loss, family issues, age, bankruptcy, injury — and you’ll be retired, jobless, income-less. Surprise! Now what do you do?

“I’ll just wing it!” some say. Completely avoiding the topic is surprisingly common. More than half of all Americans say they haven’t saved anything for retirement. Even worse, there’s far more to retirement than money — which they haven’t thought about either. Have you considered what you’ll do with your time if you’re not working? You’re a workaholic and you’ll go bonkers without a well-defined purpose. What about your social life? Do you have friends outside of work? Many people who are highly driven at work find most of their social support from co-workers. Are you and your spouse aligned on your collective future? If you haven’t had dozens of conversations about retirement with your spouse, then you’re at high risk of misalignment and marital conflict. What about your health?

“I’m healthy, I got nothing to worry about.” That’s easy to say when you’re healthy, but 24% of Americans die from heart disease and on top of that another 22% die from cancer. As you age, your risks increase. Being healthy now is fantastic, sure, but it’s never a guarantee of long-term health. You read the news — skyrocketing healthcare costs are real, and sometimes as financially debilitating as the disease itself.

“I have plenty of money so I’m not worried.” That’s great. How did you calculate that? Did you consider that a typical couple will spend $300,000 in healthcare costs in retirement? That’s after taxes too. Oh, by the way, have you considered taxes? How about hobbies? Boats and RVs are expensive. Travel is too. A decade or three of inflation will eat away at your cost of living. There simply aren’t a lot of people with enough put away to honestly say they don’t have to worry.

“You will retire one day, and you do need to plan. Sorry.”

2. Bad financial choices

Money is the foundation of a successful retirement. One easy way to get there is to earn it, save it, and invest. The growth over time will feather a very nice nest. Who do you trust your money to?

“It doesn’t matter, all financial advisors are the same.” If only it was that easy. When you look closely, you’ll find a confusing array of financial advisors and credentials. What you need is an “Investment Advisor” who is registered with the SEC or the state. Investor.gov is a good place to look them up. Your best choice is a “Fee-only Fiduciary.” Fee-only means you pay them for services rather than them earning commissions from potentially hidden sources. Fiduciary means they’re legally required to act in your best interest — not theirs. How to tell? Just ask.

“Never mind, I’ll throw it all in a safe bond fund.” If you do, you’ll be leaving a lot on the table. Historically, bonds return 4% or so (but only 1–2% these days), while blue-chip equity stocks return 8% or better (pre-tax). A wise investor will find good returns and a safe haven in a portfolio diversified with a mixture of bonds and equities. It’s easy to manage it yourself, too. Warren Buffet recommends ETFs (Exchange Traded Funds) which are already naturally diversified so you won’t feel like a Vegas gambler.

Top advisors say to keep a couple of years in a safe harbor (bond funds) and the rest can be as aggressive as you’re comfortable with.

“I can’t save anything anyway, it’s too tight right now.” I get that, life happens. Just restructure your expenses and get back in the game as quickly as you can. One absolute rule though: No matter what, if it’s offered, you MUST meet the company 401k match. Beg, borrow, or steal because most corporate programs will DOUBLE your money RISK FREE! Try to find that deal in Vegas.

“I’ll be ready because I dump all my savings into a 401k.” Surprisingly, it’s a bad idea to put everything in tax-protected accounts. Like investing, you need a nice mix. When an emergency hits, you’ll need access to quick cash, and pulling it from a 401k is time-consuming and expensive. Further, when you retire, all your withdrawals will be taxed, leaving you no flexibility to manage your way around taxes.

“It’s okay, I have a ton of equity in my home.” That’s great news, and a good place to be. The problem is it’s hard to tap into it, even worse than a 401k. You can only get to your equity by borrowing against it (bad idea because you have to pay it back), downsizing (a good idea if you need the cash, but it does take time), or a reverse mortgage (might be okay depending on your circumstances). The bottom line is it should never be a primary retirement strategy but can be a decent fallback in an emergency.

“Don’t worry. If I get into trouble, I’ll just get a job.” Sorry, but you can’t bank on going back. By the time you find out you’re in trouble, your options are either Walmart greeter or cardboard-sign-holder on the corner. Your retirement should be a one-way trip.

Remember, money is the foundation of your retirement. It pays to watch your money closely!

3. Rash Decisions

“Don’t make any rash decisions that aren’t easily reversible,” my wise father told me long ago. I’ve found it to be solid advice and it’s kept me safe from timeshares and Ferraris. Unfortunately, too many retirees didn’t know my father and aren’t thinking things through.

“I can’t stand my job so I’m quitting and retiring now!” Said millions of disgruntled employees. Those who fail to plan, plan to fail. Rushing into retirement is a dangerous adventure. Forty percent of retirees end up back in the workforce because they didn’t think it through. To make it worse, it’s likely they took jobs that paid less, and that had to hurt.

“I have enough money invested. I can quit this crap now.” The stock market has been on an upward trajectory for a lucky 13 years. That’s a long time, which makes it easy to forget how badly a market crash can devastate one’s retirement. It will happen again (hopefully small and brief). So be absolutely sure you have enough to weather a few financial storms.

“I’m smart, I can make a living day trading.” This doesn’t need extra criticism since the level of inanity is self-evident. But some people do this, and most will lose (or certainly not make a living). Even the best advisors can’t outperform the market consistently, and that’s what they’re trained to do.

“I’m taking Social Security now before it goes away.” Once you take it, you can’t go back. And don’t fall for that bankruptcy nonsense. Social Security is here to stay, so please don’t rush into it because of silly rumors. If you NEED to take Social Security now, then go for it, but for every year you wait your income increases by about 8%. Holding off from 62 to 70 and your income would almost double. That’s another gamble worth taking.

“Don’t make any rash decisions that aren’t easily reversible”

-My dad

So, it’s clear:

When it comes to retirement, there are lots of ways to goof things up. Simply knowing what they are is the antidote.

- Be honest with yourself, and question your own beliefs

- Think hard and often about your finances

- Don’t make rash decisions (that aren’t easily reversible)

Live below your means and save the difference. It’s that simple.

And remember, happiness does not come from things, it comes from friends, activities, and financial security. Not having to worry about your future is the greatest gift you can give yourself.