Photo by Isaac Smith on Unsplash

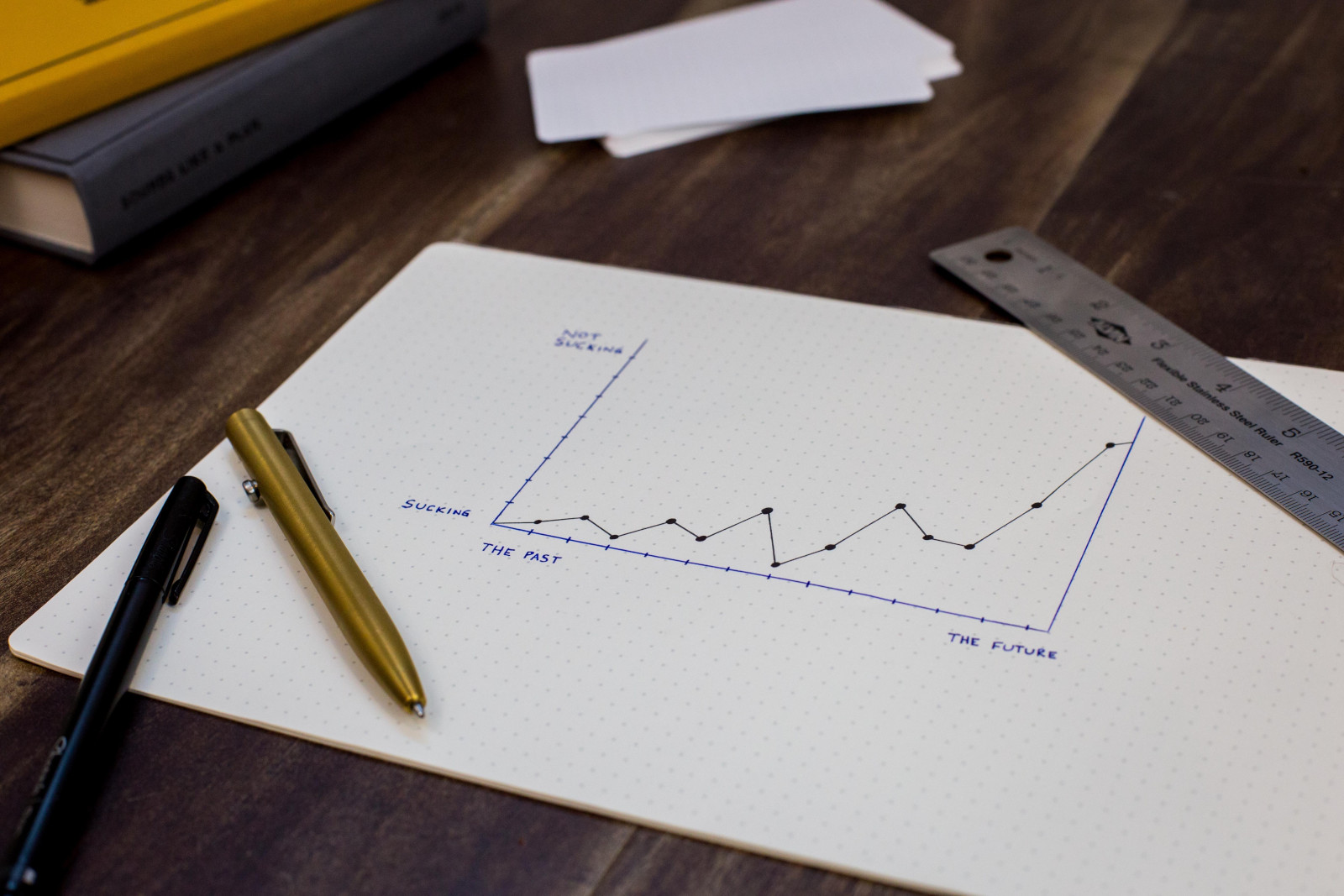

Retirement planning is a great big lie — well, almost.

Okay, that’s too much. It’s not a lie. Retirement planning is an industry with subtle biases that may not always serve your interests the best. It involves the financial press, all kinds of planners, investment managers, and others. We all need to plan for retirement, but hidden in the lessons, teaching, training, and sales pitches, there are assumptions not everyone is aware of. Watch out for these ideas as you make your plans.

Maximize Your Contributions to Retirement Accounts

While this idea will grow your retirement portfolio the fastest, it depends on your ability to fund the remainder of your life. When I did this running my own business, I always ended up cash poor. I’d put as much as I could into my SEP IRA, but then I was short on cash, and this put a crimp on how I could live. More than once it caused me to break into those accounts and take money out at steep penalties — not a fun experience. Most people are far better off-putting in a little less and staying cash solvent than they are maximizing their contribution with a risk to have to take the money out later. Plus, as you will see, it wasn’t really necessary — I could have made it up later.

“You Need $2 Million”

The first question to ask yourself when a planner says this is: Says who? And for what reason? Any specific number is arbitrary unless you are very close to retirement age, and even then, it’s questionable.

The number to focus on is not your portfolio value, but rather the amount of income you can take out of it without touching the principle. The income is far more important than the valuation, and for several reasons.

First, you can construct a portfolio to provide a flat or slowly growing income that is not susceptible to the ups and downs of the market. A company that pays $1 per share dividends pays that dividend regardless of the market price of the stock. If the stock is $25 it pays a $1 dividend, and if the stock is $20 or $30, it also still pays the $1 dividend. Hence, the income is stable regardless of price fluctuations in the underlying stock. If you had $1 million in such a stock, it would earn you a $40,000 dividend. That dividend keeps getting paid at $40,000 whether the stock reduces in value to $800,000 ($20 per share) or increases to $1.2 million ($30 per share).

Second, you can’t know the income you are going to need, especially if you are 30 years old. In that case, your retirement won’t be for another forty years. When I came out of college at 24 years old, an excellent starting salary was $20,000, and only petroleum engineers could earn that much. Today, that’s not even minimum wage in many places. During your lifetime, we will have extraordinary inflation and periods of no inflation at all. Your lifestyle could change radically between now and then, and new expenses you will deem necessary might not even be fathomable now. In 1980, for example, it was impossible to imagine PCs, cell phones, the Internet as we know it, or even cable TV. But all of those add to the expenses faced by most retirees today.

Third, market valuations can fluctuate a lot, and even if you save responsibly, you could hit $2 million and suddenly find yourself with only $1.4 million or less due to market volatility. As pointed out above, if you live on dividends, that volatility in and of itself does not matter. If, however, you need to liquidate shares because you are living on the principal at a time of low valuation, you are robbing your future because you have less to grow back with and your income could vary substantially. Plus, the principle is reduced so that even growth that would get you back where you started won’t be enough. The bad timing of these fluctuations and withdrawals can have a devastating impact on the value of your portfolio, and if you use your portfolio this way, it will affect your income and lifestyle.

“You aren’t saving enough”

Over and over again, the financial industry says most people are behind and not saving enough. This CNBC article quotes: Approximately half of Americans are at risk of not being able to maintain their pre-retirement standard of living after they stop working,” said Angie Chen, a research economist at the Center for Retirement Research at Boston College.

This is based on an assessment of people meeting the so-called Rule of 25, which “suggests saving 25 times your expected annual expenses in retirement. Meeting that guideline will allow you to withdraw 4% of those savings annually over a 30-year time horizon.”

Here’s what they don’t tell you: For most people, once your kids are into adulthood, you are at the top of your earning years, and you can put away a TON more money than you can when you are young. The kids are moved out and on their own. Your income is higher than it has ever been. Whatever contribution you may have made to college is done. Your expenses drop precipitously, you sell your home and cash out to find a new place with no or very low mortgage. All of a sudden, you can put away far more money than ever before and enjoy your life more. Hence, catching up in the years from 50 to 67 is a real possibility for most people.

I would never recommend waiting totally until 50 or 55 to get started, but maxing out on retirement all the time can have consequences. You should live your life and enjoy it now, as well as save for the future.

“Better Not Plan on Social Security”

They want you to believe social security will not be there by the time you retire, but they are wrong. It is the single most successful anti-poverty program the US has ever seen, and the biggest voting block — seniors — depend on it. The only chance of it going away would be via the rise of fascist government, a prospect I wrote about here. Barring that possibility, social security is here to stay. It’s not going broke; it will just get fixed every so often.

If you assume there will be no social security, you will have to replace the income with a bigger investment portfolio or with extra work in retirement. It makes the hill just that much bigger to climb.

Why do they say these things then?

The press, the fund managers, and the financial planners all have one thing in common: If there isn’t any investment to manage, there’s no money to be made. Even fee-based planners need the customer to have investable cash so their fees can deliver value to their customers. Commission-based planners get their commission. Fund managers get a fee based on the value of the assets being managed. As for the press, the more people involved in investing, the more valuable the publication or media is. Hence, the industry has a built-in bias toward getting more people to invest, despite their good work as professionals. Everyone has an interest in getting you to be an investor. I don’t see this as problematic, just something to be aware of as you think about investing for your retirement.

You can find my newsletter Intertwine: Living Better in a Worsening World here.

Anthony Signorelli

Ideas, insights, and imagination to help you live better in a worsening world.

To help me continue this work and find other insightful writing, join Medium here. It’s only 5 bucks and Medium pays me half to keep this work going. Much appreciated.